What Does San Diego Home Insurance Mean?

Secure Your Tranquility of Mind With Reliable Home Insurance Coverage

Why Home Insurance Coverage Is Necessary

The value of home insurance lies in its capacity to supply economic defense and assurance to homeowners in the face of unexpected events. Home insurance coverage functions as a security internet, using protection for damages to the physical structure of the home, personal possessions, and liability for accidents that may take place on the home. In the occasion of natural disasters such as fires, quakes, or floodings, having a comprehensive home insurance coverage plan can assist property owners recover and rebuild without encountering considerable monetary concerns.

Furthermore, home insurance coverage is frequently required by mortgage lending institutions to shield their financial investment in the building. Lenders desire to make sure that their monetary rate of interests are guarded in instance of any kind of damages to the home. By having a home insurance plan in location, property owners can satisfy this requirement and secure their investment in the residential or commercial property.

Sorts Of Coverage Available

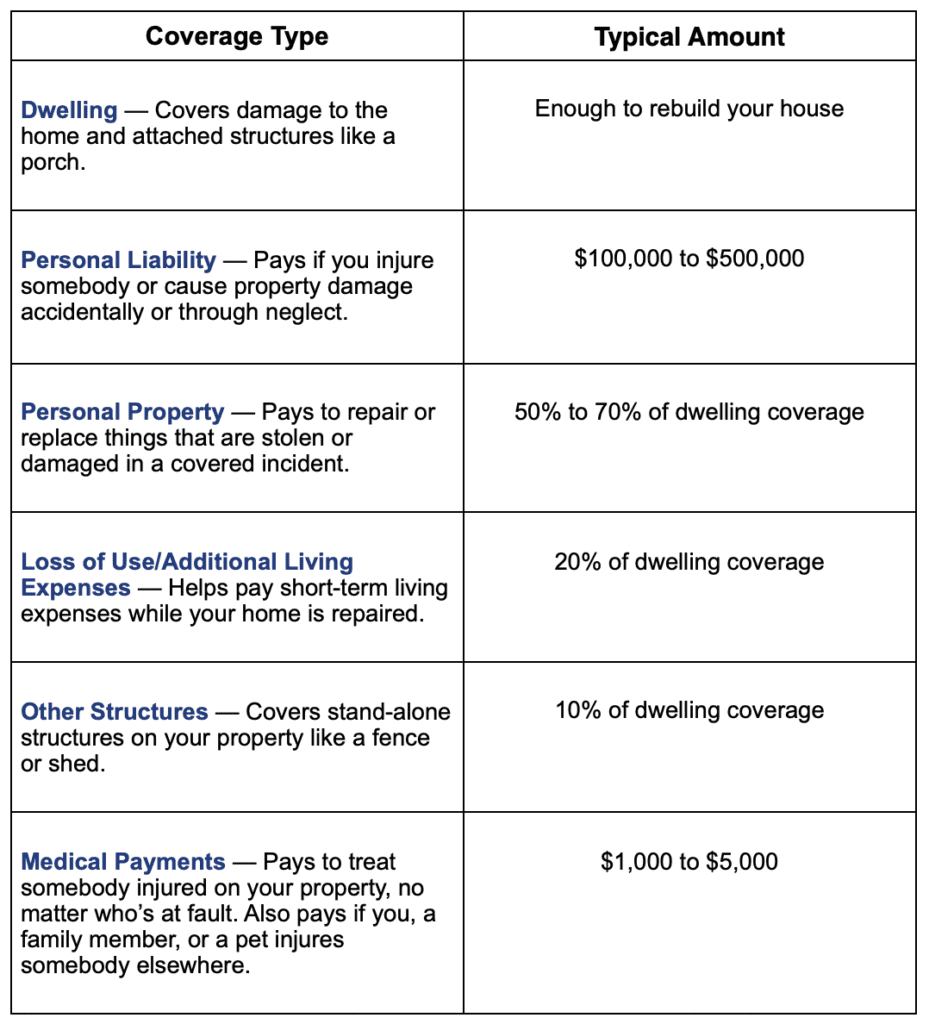

Offered the importance of home insurance coverage in safeguarding home owners from unanticipated economic losses, it is critical to understand the different kinds of coverage offered to customize a policy that fits private demands and situations. There are numerous essential kinds of insurance coverage offered by a lot of home insurance policy policies. Personal property protection, on the various other hand, safeguards belongings within the home, including furniture, electronic devices, and apparel.

Factors That Impact Premiums

Aspects affecting home insurance coverage costs can differ based on a variety of factors to consider details to private circumstances. Older homes or homes with obsolete electric, plumbing, or home heating systems might present higher dangers for insurance policy business, leading to higher costs.

Additionally, the insurance coverage limitations and deductibles chosen by the insurance holder can impact the premium quantity. Going with higher protection limits or reduced deductibles typically causes higher costs. The kind of building and construction materials made use of in the home, such as wood versus block, can also influence premiums as specific materials might be much more at risk to damage.

Exactly How to Choose the Right Plan

Selecting the proper home insurance coverage policy includes cautious consideration of different vital aspects to guarantee detailed insurance coverage tailored to private requirements and circumstances. To begin, evaluate the worth of your home and its contents accurately. use this link Next, think about the various kinds of insurance coverage available, such as house insurance coverage, individual home coverage, obligation defense, and added this hyperlink living expenditures insurance coverage.

Furthermore, assessing the insurer's reputation, financial stability, customer service, and claims process is essential. Search for insurance companies with a background of trusted solution and punctual claims settlement. Ultimately, contrast quotes from several insurance companies to discover a balance between cost and insurance coverage. By carefully evaluating these factors, you can pick a home insurance coverage that supplies the necessary security and tranquility of mind.

Advantages of Reliable Home Insurance Coverage

Dependable home insurance uses a sense of safety and protection for home owners against unpredicted events and economic losses. Among the key benefits of trusted home insurance coverage is the guarantee that your residential property will be covered in the occasion of damages or destruction triggered by natural catastrophes such as fires, tornados, or floodings. This protection can aid property owners prevent birthing the full expense of fixings or rebuilding, supplying assurance and financial security throughout challenging times.

Additionally, trustworthy home insurance policies commonly consist of liability protection, which can secure homeowners from legal and medical expenditures in the case of mishaps on their property. This protection prolongs past the physical framework of the home to protect against claims and cases that may occur from injuries suffered my review here by site visitors.

Moreover, having trustworthy home insurance policy can also contribute to a sense of total well-being, understanding that your most considerable financial investment is guarded versus numerous risks. By paying normal costs, homeowners can mitigate the potential financial burden of unanticipated occasions, permitting them to concentrate on appreciating their homes without consistent bother with what could occur.

Final Thought

Finally, safeguarding a dependable home insurance plan is necessary for safeguarding your property and items from unforeseen events. By recognizing the kinds of coverage readily available, aspects that impact costs, and how to select the ideal policy, you can guarantee your comfort. Relying on a dependable home insurance policy company will certainly provide you the advantages of financial security and protection for your most important property.

Navigating the realm of home insurance policy can be complex, with different coverage choices, plan factors, and considerations to consider. Understanding why home insurance coverage is crucial, the types of insurance coverage readily available, and how to select the appropriate policy can be essential in guaranteeing your most significant financial investment continues to be secure.Provided the relevance of home insurance in safeguarding house owners from unanticipated financial losses, it is essential to comprehend the different kinds of insurance coverage available to tailor a policy that fits specific needs and scenarios. San Diego Home Insurance. There are several vital types of coverage provided by many home insurance policies.Picking the appropriate home insurance policy involves mindful factor to consider of various key aspects to ensure comprehensive insurance coverage customized to specific demands and scenarios